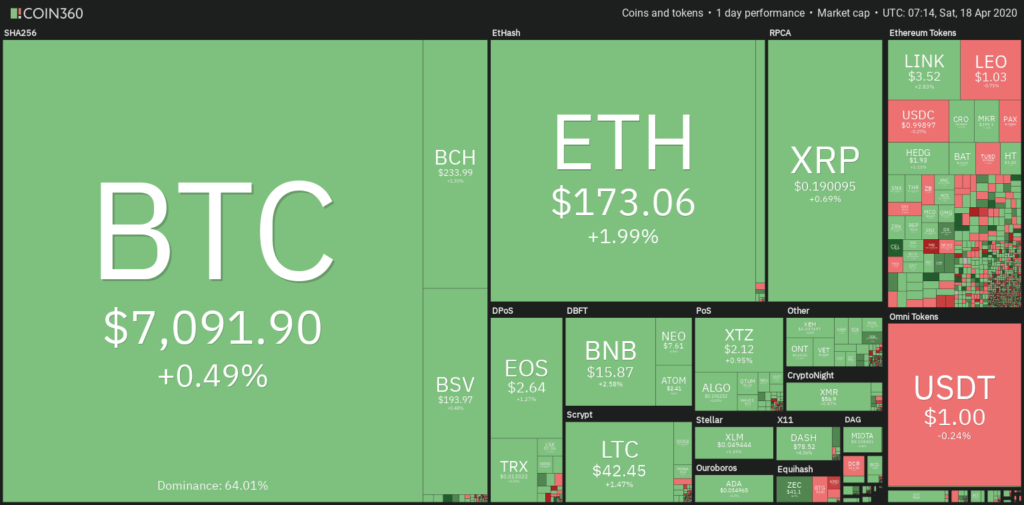

Bitcoin is peaking up the pace after the Black Thursday. Bitcoin price drop from $7900 to $3700 on 12 March. Bitcoin has almost covered all the losses within a month while the stock markets and forex markets are still suffering due to the Coronavirus pandemic. Bitcoin is now trading around $7100.

Bitcoin price quickly bounces back from $3700 and made a high of $7500 after three weeks of the drop. That is a good sign and this will definitely attract investors that are looking for short term profits. The gold market is also recovered from the losses of the Black Thursday and closed on $1683 on 17 April.

Here is the technical analysis of the top three cryptocurrencies: Bitcoin (BTC), Ethereum (ETH) and XRP.

Bitcoin (BTC/USD) Technical Analysis

Bitcoin is now trading around $7100 and yesterday see a daily candle of $700. The price increase from $6450 to $7150. Bitcoin is an uptrend on the daily chart. The price tested the bottom line of the trend channel and see a quick bounce back from there.

The daily 50 MA resistance is finally broken after many attemts. Bitcoin is holding the daily 50 MA and it is now acting as support zone. The next major resistance is the daily 200 MA that is now around $8000, this is also psychological reistance beacuse of round figure.

The weekly chart of Bitcoin is also bullish. If bulls able to close the weekly candle above $7100 this is a good sign for further upward movement. The fundamental event Bitcoin halving is also coming in 3 weeks that will also pump the price of Bitcoin for a short time. Bitcoin probably tests $8500-$9000 zones before halving.

Bitcoin weeky candle also breaks the long downtrend line that will gives bulls a good chance to pump the price. The RSI is slowly increasing and above 40 that is a good sign.

If Bitcoin price fall below $6500 and daily or weekly candle close below that point all the above cases are invalid and the market turn bearish.

Ethereum (ETH) Technical Analysis

Ethreum is now trading around $173. The horizontal resistance is $175 if ETH able to break it and hold above it then the next resistance is $195-$200 zones. There is also a bull flag pattern on the chart which is likely to explode in upward direction. Bull flag is a well known bullish sign for market.

The immediate support zone for ETH is the hourly 200 MA that is around $161. If Ethereum unable to hold the hourly 200 MA than it will test the major support of $150.

The ETH/BTC pair looks very good and pumped with Bitcoin. This is a very good sign for ETH and other alts. We will see a small alt rally around the Bitcoin halving.

XRP/USD Technical Analysis

The daily chart of XRP looks very good. XRP is moving in an uptrend channel and tested the bottom and top lines of the channel. XRP price is now trading above the daily 50 MA which is a good sign. The next major resistance is the daily 200 MA that is around $0.23. If XRP price is able to break above the daily 200 MA then we will see a quick rally.

The rally is similar to the previous rally of XRP. The previous rally of XRP start from 3 Jan 2020. The price made a high of $0.34 that is around 90% gains from the starting of the rally price $0.18. The RSI is following the same pattern and respecting the trend line. If XRP follows the same rally pattern then the rally will made a high of $0.23 that is more 100% gains from the lowest point of $0.11.

This post is only for educational purpose and Bitcoinik is not responsible for any profit or loss.