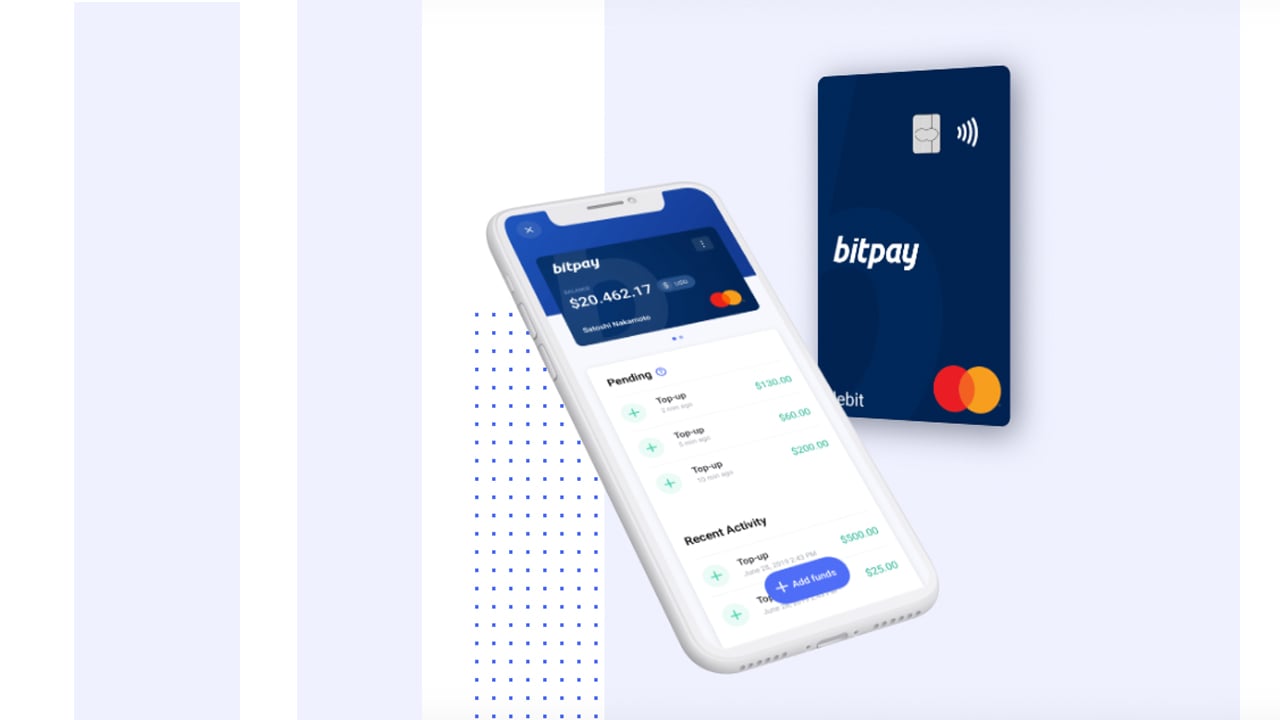

On June 11, 2020, the cryptocurrency payment services provider, Bitpay announced the firm is launching a prepaid Mastercard that can be loaded with a variety of digital assets. The Atlanta-based company says the card can be spent anywhere Mastercard is accepted and users can “instantly convert cryptocurrency into fiat currency.”

For quite some time now, the Atlanta-based Bitpay has offered a prepaid Visa card that allows users to load cryptocurrencies in exchange for USD. On Thursday, Bitpay revealed the company has partnered with Mastercard (MC) and the new product is the “first [MC] prepaid card in the U.S. market for the blockchain community.”

Unfortunately, the company’s Visa prepaid Bitpay card services will end on December 31, 2020. “This program termination means that all Bitpay prepaid Visa cards will expire and stop working on December 31, 2020, regardless of the expiration date printed on your card,” the firm explains.

Spends will end in December, while July 31, 2020, will be “the last day you will be able to load funds to your card including converting cryptocurrency to fiat for use. Please redirect any recurring bank deposits, such as payroll, before this date.”

Bitpay will instead offer prepaid cards that wield the American multinational financial services corporation’s logo, which means it can be used anywhere MC payments are accepted.

“The Bitpay Card offers new benefits and features for consumers making it easier to convert Bitcoin and other cryptocurrencies into a spendable balance without currency risk,” Stephen Pair, co-founder, and CEO of Bitpay explained during the announcement. Pair further added:

We are excited to work with Mastercard to expand crypto’s use, while making it easy for businesses to attract new customers who want to spend Bitcoin and offer more places for customers with Bitcoin to shop.

Just like the firm’s flagship Visa prepaid card, people will be able to load BTC, BCH, ETH, XRP, and the stablecoins USDC, GUSD, PAX, and BUSD. Similarly, Bitpay MC prepaid card users can “also use their cards online for purchases and to withdraw cash from (automated teller machines) ATMs.”

The Atlanta company says that the card is “safe” and features an “EMV chip” as well. The Bitpay MC prepaid card’s EMV chip bolsters security and enables contactless-payments too. Loaded funds are made available after one blockchain network confirmation, and the card also tracks and manages card spending.

“At Mastercard, we’re committed to offering differentiated financial services to consumers on a global scale,” said Sherri Haymond, executive vice president, Digital Partnerships at Mastercard. “We’re excited to be working with Bitpay to offer consumers greater choice and flexibility when it comes to managing their finances,” Haymond added.

The prepaid MC cards are also issued in the United States are supported in all 50 US states. Bitpay says that prepaid MC customers have to be 18 years or older, and they also must “successfully complete identity and residency verification.”

What do you think about the Bitpay prepaid Mastercard? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bitpay

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer